This is the most important thing to take care of while planning your finances. Simply speaking liquidity is the ability to convert your assets into money.

This is very important especially in emergencies. The reason is simple - a large number of problems can be solved by ready cash. This is more important for people in their first few years for various reasons. One is that they have settled into a rhythm and so "unexpected" expenses suddenly crop up. Second is that often people have a lot of responsibilities and hence they need money to fulfill them.

Scenarios

Lack of planning

I remember that in my first year after marriage, money was chronically short. The reason was not that my I was a spindrift (nor my wife for that matter). It was just that there a number of expenses that we had not accounted for. We would forget to pay some of our bills in time. The rent would have to be paid and suddenly our account would be empty. Just after getting the salary we would feel that we have a lot of money and hence would splurge on capital items like washing machine and AC.

Sure, we could have planned better but I think this is a problem that everyone of my friends faced. It seems that planning requires experience and at this stage everybody lacks it so it simpler to just have some cash at hand (or in the back).

Commitments

One of my friends was very happy after getting a job. Just before filing his first tax return, he got an expensive insurance policy to save tax. Unfortunately, the policy would give him no money for the first 10 years while devouring a significant chunk of his savings. Unfortunately he had a lot of responsibilities - getting three of his sisters married over the next five years. In this scenario, the insurance policy made no sense. The main problem was that the policy was not liquid - it could not be converted to cash when required. My friend would have been better off paying the tax - he was in the 10% bracket.

Liquidity is higher when it takes less time to convert to cash AND when the penalty for coversion to cash is less.

Basic rules of thumb about liquidity

- Cash and money in savings account are the most liquid

- Fixed deposits and funds in money market funds are very highly liquid - these can be converted to cash in less than a day and have a low penalty.

- ETFs, stocks and other instruments in demat account are next - these can be converted to cash in 2-3 days but because of market fluctuation, there may be loss

- Mutual funds, ULIPs and some insurance policies - These often take one to two weeks to convert to cash as there is paperwork involved. Further, there may be substantial loss depending on the terms and conditions.

- Property - this can often take months to convert to cash and may involve significant loss in case of distress sale

- Retirement funds, PPF, EPF, most LIC policies, NSC - These are often nearly completely illiquid - they can not be disposed of before a predefined period which ranges from 5-30 years.

Conclusion

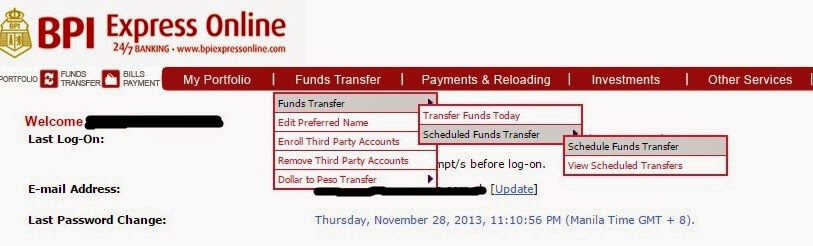

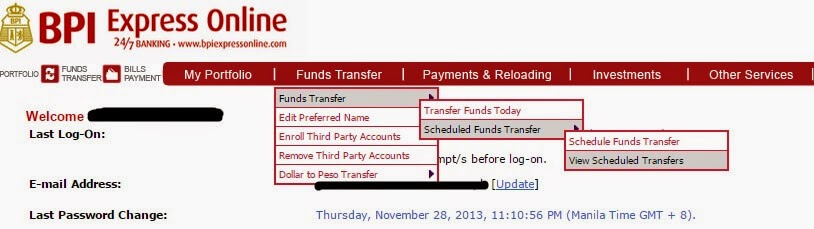

Given the above, my sense is that people should get a netbanking, demat and trading account and invest in FDs and ETFs till their early responsibilities are over.